Sir Sam Jonah tags UT Bank closure as 'economic injustice'

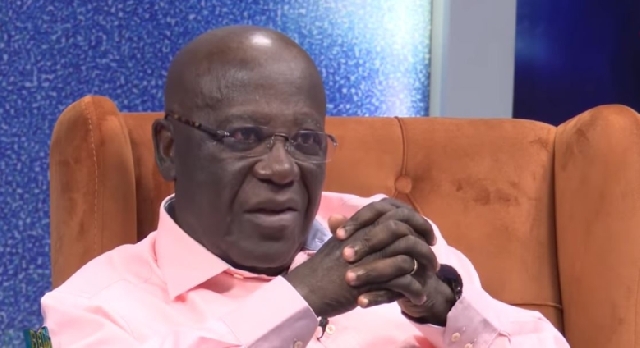

Sam Jonah

Sam Jonah

Renowned businessman and Executive Chairman of Jonah Capital, Sir Sam Jonah, has strongly criticized the closure of UT Bank, describing it as a significant act of economic injustice that has stifled private sector growth in Ghana.

He argued that the government's decision to shut down the bank six years ago has had far-reaching consequences, discouraging ambitious entrepreneurs from pursuing transformative ventures.

Speaking at the launch of 'The UT Story: Volume 3' by Prince Kofi Amoabeng, Sir Sam Jonah underscored the critical need to protect businesses from undue political interference.

He emphasized that a stable and predictable business environment is essential for long-term economic prosperity, warning that excessive state control undermines investor confidence and stifles entrepreneurial ambition.

Reflecting on the closure of UT Bank, he described it as a painful chapter in Mr. Amoabeng’s journey, highlighting the betrayal and harsh realities that come with power and politics.

“The seizure of his bank was one of the most egregious acts of economic injustice perpetrated by the state; a move driven by malice, deceit, envy, and jealousy,” he lamented.

Sir Sam Jonah further noted that the bank’s collapse was not just a financial failure but a symbolic setback for Ghanaian entrepreneurship.

He stressed that it sent a chilling message to business owners and innovators—that no matter how diligent, rule-abiding, and hardworking they may be, their success could be undone at any moment by those in authority.

He urged policymakers to learn from such events and prioritize the creation of a business-friendly environment that fosters growth rather than suppressing ambition.

According to him, Ghana’s economic progress depends on the ability of its leaders to nurture and support the private sector rather than allowing political agendas to dictate the fate of thriving businesses.

In response to the challenges faced by entrepreneurs, Prince Kofi Amoabeng expressed optimism about fostering a new generation of transformational leaders rather than merely restoring the bank. 7

“The vision that I have now is bigger than the bank: it is about how we can groom and create leaders with the right values who can change the narratives,” he stated.

The event, attended by leading CEOs and business executives, saw the first copy of 'The UT Story: Volume 3' sold for GHS 50,000, reflecting the high level of interest in Amoabeng’s experiences and insights.

The collapse of UT Bank in 2017 was part of a broader banking sector crisis in Ghana, which saw the revocation of licenses of several banks due to issues such as undercapitalization and poor corporate governance.

The Bank of Ghana cited UT Bank's severe impairment of capital as the reason for its closure.

Sir Sam Jonah's remarks have reignited discussions on the balance between regulatory enforcement and support for indigenous enterprises, emphasizing the need for policies that protect businesses from arbitrary political actions.

Source: Classfmonline.com/Cecil Mensah

Trending Business

Sir Sam Jonah tags UT Bank closure as 'economic injustice'

15:49

Mahama opens National Economic Forum on March 3

11:37

We’re not selling ECG – Energy Minister Insists

10:35

Ablakwa opens 24-hour shift at passport office

14:46

Organized Labour gets 10 percent base pay

14:19

N-Gas insists it won’t supply gas to Ghana over unpaid arrears

05:39

NPA boss tours fuel installations to assess operations

03:42

Energy Minister meets AGI and Budget Department to strengthen collaboration

02:42

Labour Ministry engages private employers on GLMIS

14:03

Alex Mould takes over as CEO of Millennium Development Authority

12:09