Asanko Gold announces normal course issuer bid

Asanko Gold

Asanko Gold

Asanko Gold Inc. (TSX, NYSE American: AKG) has announced that the company intends to make a normal course issuer bid (the "NCIB") to purchase up to 5% of Asanko's issued and outstanding shares.

The ability of the company to commence the NCIB, as well as all the relevant terms of the NCIB discussed in this press release, is dependent on the Company receiving Toronto Stock Exchange ("TSX") approval of the NCIB, and the Company intends to file a notice of intention with the TSX in this regard.

The exact amount of common shares subject to the NCIB will be determined on the date of acceptance of the notice of intention by the TSX. Purchases pursuant to the NCIB are expected to be made on the open market through the facilities of the TSX and the NYSE American Stock Exchange ("NYSE American") and other Canadian trading platforms.

All common shares purchased by Asanko under the NCIB will be purchased at the market price at the time of acquisition in accordance with the rules and policies of the TSX and NYSE American and applicable securities laws. All common shares acquired by Asanko under the NCIB will be cancelled and purchases will be funded out of Asanko's working capital. Although Asanko has a present intention to acquire its common shares pursuant to the NCIB, Asanko will not be obligated to make any purchases and purchases may be suspended by the Company at any time.

In accordance with the rules of the TSX, the maximum daily purchases on the TSX under the NCIB will be 33,400 common shares, which is 25% of the average daily trading volume for the Company's common shares on the TSX for the six months ended October 31, 2019. In addition, maximum daily purchases under the NCIB on the NYSE American will be subject to Rule 10b-18 which specifies that daily purchases may not exceed 25% of average daily trading volume for the four weeks preceding such trading date. These maximum daily limits will apply to purchases on the respective markets, except where such purchases are made in accordance with "block purchases" exemptions under applicable TSX and NYSE American policies.

Asanko proposes to commence the NCIB because, in the opinion of its board of directors, the market price of its common shares, from time to time, may not fully reflect the underlying value of its mining operations, properties and future growth prospects. Asanko believes that in such circumstances, the outstanding common shares represent an appealing investment option for Asanko since a portion of the Company's cash balance can be invested for an attractive risk-adjusted return through the NCIB. The board of directors of the company believes that the proposed purchases are in the best interests of the company and are an appropriate use of corporate funds.

The company intends to enter into a share purchase plan (the "Plan") to facilitate the purchase of common shares pursuant to the bid and under which its broker may purchase common shares according to a prearranged set of criteria. If implemented, the Plan will enable the purchase of common shares at any time, including when the company would not ordinarily be active in the market because of internal trading blackout periods, insider trading rules or otherwise.

To the knowledge of the company, no director, senior officer or other insider of the company currently intends to sell any common shares under the NCIB. However, sales by such persons through the facilities of the TSX or NYSE American may occur if the personal circumstances of any such person change or any such person makes a decision unrelated to these purchases under the NCIB. The benefits to any such person whose shares are purchased would be the same as the benefits available to all other holders whose shares are purchased.

The company intends to commence the NCIB two trading days after TSX acceptance of the NCIB. The NCIB will terminate one year after its commencement, or earlier if the maximum number of shares under the NCIB have been purchased. The Company reserves the right to terminate the NCIB earlier if it feels it is appropriate to do so. The Company has not made any purchases of its common shares during the past twelve months.

About Asanko Gold Inc.

Asanko is focused on building a low-cost, mid-tier gold mining company through organic production growth, exploration and disciplined deployment of its financial resources.

The company currently operates and manages the Asanko Gold Mine, located in Ghana, West Africa which is jointly owned with Gold Fields Ltd.

The company is strongly committed to the highest standards for environmental management, social responsibility, and health and safety for its employees and neighbouring communities.

Source: Classfmonline.com

Trending Business

GoldBod begins licensing of gold trading service providers

11:48

President Mahama appoints Capt. James Richmond Quayson as the Director of Takoradi Port

13:10

Mahama pledges support for private sector growth after successful Kwahu Business Forum

01:02

NPA reaffirms commitment to strengthen partnership with GBC

15:43

Adwumawura Programme will end youth unemployment – NEIP CEO

07:38

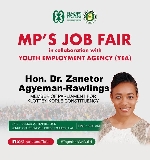

Zanetor Agyeman-Rawlings to host job fair for Klottey Korle constituents

02:55

Mahama launches Adwumawura to create 10,000 youth-owned businesses annually

01:33

President Mahama appoints Matilda Asante-Asiedu as Second Deputy Governor of Bank of Ghana

18:38

Tema port delays threaten livelihoods as importers battle mounting demurrage costs

12:17

President Mahama launches major youth employment initiatives: Adwumawura and National Apprenticeship programme

11:25