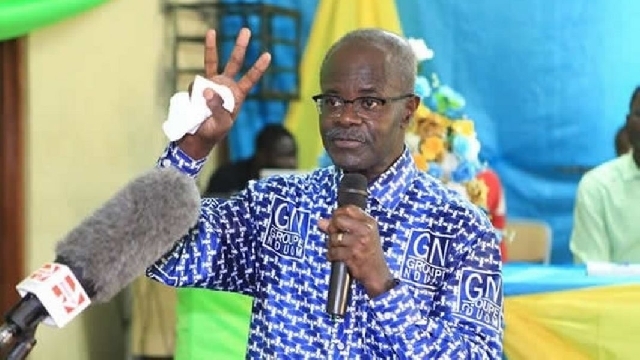

GN Bank: Give us back our license and assets – Nduom to BoG

Dr. Nduom expressed confidence in their ability to meet the necessary capital requirements

Dr. Nduom expressed confidence in their ability to meet the necessary capital requirements

The owner of the defunct GN Bank, Dr. Kwesi Nduom, has issued a fervent appeal to Dr. Ernest Addison, Governor of the Bank of Ghana (BoG), to reconsider new evidence and reinstate the bank’s license, which was revoked due to alleged insolvency.

In a Facebook video, on Sunday, 23 June 2024, Dr. Nduom implored the central bank to preserve GN Bank’s assets, asserting their viability and readiness to resume operations if the license is reinstated.

"All that we’re asking the Governor, Dr. Addison, is to take a look at the new facts, recognise them for what they are, and give us back our license, give us back our assets," he said.

"Make sure the assets are in good condition, and let’s move on,” Dr. Nduom implored.

In 2018, BoG’s efforts to consolidate the banking sector resulted in the revocation of licenses from several financial institutions, including GN Bank. On June 14, BoG defended its decision, citing significant regulatory breaches and claiming GN Bank failed to meet crucial financial regulations and banking standards, threatening its operational stability.

Dr. Nduom vehemently disputed BoG’s claims about GN Bank’s capital inadequacy, urging Dr. Addison to reexamine evidence from the 2019 GN Savings and Loans transition report. He contended that the report demonstrates the bank had sufficient funds.

“So, when people ask what do you want? All that we’re saying is that recognise that indeed there was more money there than was said to be just proof. Recognise the proof,” he stated.

Emphasising the bank’s readiness to operate even as a savings and loans company, Dr. Nduom expressed confidence in their ability to meet the necessary capital requirements.

“Even in the reclassified state as a savings and loans company, we are prepared to start working. And we know once all the accounting is done, once the funds start coming in, everybody will realise that the 305-branch network of GN Savings will deserve to become a universal bank—GN Bank again,” Dr. Nduom stated.

Highlighting the broader impact of the bank’s reinstatement, Dr. Nduom envisioned employing thousands of people and revitalising hundreds of branches to promote financial inclusion. “What we are looking for is to go back and put thousands of people back to work and 100s of branches, so that financial inclusion can resume.”

Dr. Nduom pointed out that the requirement for a savings and loans company is GHS15 million, arguing that the erroneously reported GHS30.3 million by the finance ministry to BoG could have met this requirement if appropriately allocated.

“Even the GHS30.3 million that the finance ministry erroneously told the BoG that Group Nduom companies had... if they paid us and we paid into GN Savings, that would have been able to give us the capital required to continue on our savings and loans,” he emphasised.

Dr. Nduom lamented the rejection of their proposed capital contributions, including properties and branch buildings, which he claims were left to deteriorate by BoG’s appointed receiver.

“It was all rejected, and these are the same buildings that BoG’s appointed receiver went around hurriedly to put locks on the gates and buildings and walked away. Left them to rot, all of those things still there,” he added.

Source: classfmonline.com/Elikem Adiku

Trending Entertainment

Criss Waddle frames Alabaster Box as 'wicked, desperate bullies' for money suing Medikal over alleged IP infringement

19:19

Easter: Obomeng chiefs issue warning on indecent dressing

14:40

MC Portfolio reveals relationship with Shatta Wale before getting to know Stonebwoy

03:20

2025 TGMAs: I’d permanently leave Kumasi if King Paluta doesn't lift Artiste of the Year trophy – MC Portfolio

03:01

Going up 2024 TGMA stage with Stonebwoy ‘catapulted me to another level’ – MC Portfolio

02:43

‘Just say you don’t like my music, its simple’ – Bosom P. Yung reacts to ‘fell off’ mockery

01:38

KiDi confident about sweeping 4 trophies but gingers fans to vote

01:13

'Akwaaba (Welcome)' and 'Welcome to Africa': Alabaster Box sues Medikal for GHS10m

19:42

P-Square: Peter Okoye testifies against elder brother Jude in money laundering case

19:19

Katy Perry off to space with 5 other women in first all-female space crew in over 60 years

01:29