Insurance brokers secure best deals for policyholders at no additional cost – IBAG President

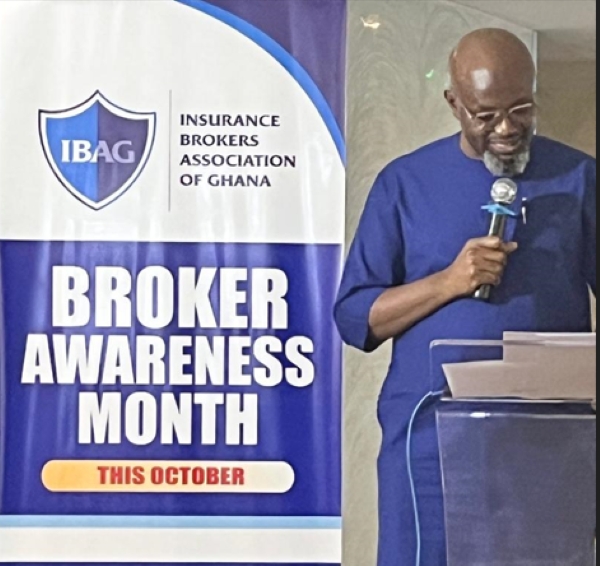

Mr. Shaibu Ali

Mr. Shaibu Ali

The public has been encouraged to seek the services of qualified insurance brokers to ensure they receive accurate information and fair treatment in insurance matters.

According to the President of the Insurance Brokers Association of Ghana (IBAG), Mr. Shaibu Ali, “using a broker comes at no extra charge, as their fees are already included in the insurance premium under a section known as the "acquisition cost." This cost compensates brokers for their services without adding any additional burden on the policyholder”.

Mr. Ali made this clarification during an interaction with the media at the Kempinski Hotel in Accra, on Tuesday, 8 October 2024.

Insurance Brokers represent Clients’ best interests

Mr. Ali highlighted that “insurance brokers serve as independent, professional intermediaries, acting in the best interests of their clients. Their role is to help individuals and businesses select the right insurance products, negotiate fair premiums, and secure favourable terms from reputable insurers”.

He further stated that: “By working with a licensed broker, clients benefit from personalised advice tailored to their unique needs. Brokers ensure clients have the right coverage and assist them through the often complex claims process, providing guidance on necessary procedures and documentation”.

A Smoother Claims process with Brokers

One major advantage of working with a broker, Mr. Ali pointed out, “is a smoother claims process. Brokers hold accountability for all aspects of the insurance policy and make it easier for clients to navigate the often-difficult task of filing claims”.

“With their deep understanding of the insurance market, brokers ensure clients are getting the best value for their premiums and dealing with trustworthy insurance providers. Mr. Ali also cautioned that individuals who purchase insurance from non-insurance institutions often encounter difficulties when making claims”.

Avoid Insurance products sold by non-insurance institutions

Mr. Ali raised concerns over the increasing trend of financial institutions selling insurance products. He noted that “many clients end up having negative experiences because these institutions lack the professional expertise needed for insurance services”.

“This trend has contributed to much of the negative publicity surrounding the insurance industry, he explained. Furthermore, he noted that if a broker fails to renew a policy and a claim is made, the broker is liable and must compensate the client under their professional indemnity cover, which must be no less than GHS500,000”.

October campaign to raise awareness

In recognition of the important role brokers play, Mr. Ali stated that: “IBAG has designated October as a month to raise public awareness about the value of insurance brokers. Established on October 27, 1988, IBAG began with 15 licensed broker firms and has since grown to 102 members”.

IBAG ‘serves as an advocate for insurance consumers, promoting public understanding of insurance and the importance of using licensed brokers’’.

Importance of Protection During Economic Uncertainty

With ongoing economic challenges, Mr. Ali stressed the need for individuals and businesses to ensure they have adequate insurance coverage to protect themselves from unforeseen events.

He said: ‘The public must endeavour to always purchase insurance from licensed and authorised providers to avoid complications down the road’.

He concluded by encouraging collaborations with the media to help demystify insurance, inform consumers of their rights, and enhance overall public understanding of the industry for improved financial security.

Trending Business

Labadi Beach Hotel secures injunction in land dispute with Polo beach Club

01:31

NDC gov’t will act swiftly to cater for first quarter expenditure after January 7 – Ato Forson to Ghanaians

21:05

You’ll have stable power supply this Christmas – ECG assures Volta, Oti residents

12:43

Present 2025 mini-budget or risk a jail term - Ato Forson to Finance Minister

16:46

Asian African Consortium now African Agribusiness Consortium

18:12

NPA promotes LPG usage in Western Region

13:02

UNDP calls for increased focus on non-life insurance in Ghana

09:12

Sugarcane farmers urge revival of Komenda Sugar Factory

03:19

NIC inaugurates steering committee to drive inclusive insurance in Ghana

00:58

We’re handing over a strong economy – Amin Adam

13:46