Collapsed banks: Gov't unable to pay depositors because of weak economy – Financial Analyst

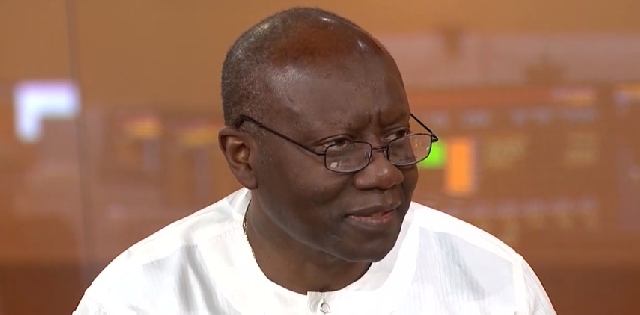

Ken Ofori-Atta Finance Minister

Ken Ofori-Atta Finance Minister

A financial analyst, Dr Amoh Baffour, has decried the inability of the Akufo-Addo administration to pay customers of the defunct microfinance and savings and loans companies.

Dr Baffour, who is with the Business Administration Department of the Pentecost University, said he was surprised the governing New Patriotic Party (NPP) administration had failed to pay depositors of the banks that the government collapsed during its banking sector clean-up.

In the past two years, the Bank of Ghana’s reforms has led to the collapsed of nine local banks, 347 microfinance institutions and some 23 finance houses.

On 1 August 2018, the Bank of Ghana announced the consolidation of the failed local banks, which included the Royal Bank, Beige Bank, Construction Bank, Sovereign Bank and uniBank. Later on, HBL and Premium Bank were added to the first five.

The collapse of the nine local banks birthed the state-owned Consolidated Bank Ghana (CBG) Limited.

]This was after the Central Bank on 14 August 2017 approved the takeover of UT Bank and Capital Bank, by the state-owned GCB Bank Limited.

Dr Baffour believes the country's economic indicators have not been favourable for the past few years, hinting that could be an underlying factor hurdling the payment processes the government announced.

"If the government finds it difficult to pay the depositors, it proves one thing: that the economy is not in good shape," Dr Amoh told journalists.

He also noted that while the government has failed to boost the economy as promised, paying the depositors will not come easy because inflation will expose it.

"Government cannot print monies to pay the depositors. The government does not have any free money elsewhere to settle the depositors. The Government should have supported the microfinance companies and failing banks with a bailout to sustain jobs and avert this pressure. I say this because the business would have moved up steadily and sustained the economy," he added.

Last year, President Akufo-Addo announced some GHS15.6 billion had been allocated to pay customers who had their monies locked-up in these collapsed financial institutions.

A letter addressed to the Minister of Finance, Mr Ken Ofori-Atta, by the President’s Executive Secretary Nana Asante Bediatuo, said, “The President has granted executive approval for an expenditure of up to fifteen billion six hundred million Ghana cedis (GHS15,600,00,00.00) toward protecting depositors and investors of failed financial institutions and to improve the liquidity of the financial sector”.

At the 2020 State of the Nation Address, Mr Akufo-Addo again confirmed before Parliament the monies have been released and stated payment was to begin on February 24, 2020.

However, four months after the pledge, the disgruntled customers are yet to receive their funds in full.

Source: classfmonline.com

Trending Business

Gov't gets MoU with official creditor committee to formalize debt relief

13:49

New NPA boss pledges to take the Authority to the next level

10:31

Shafic Suleman appointed Acting Executive Secretary of PURC

11:48

Tripartite Committee begin negotiations on 2025 minimum wage

11:13

Maame Efua Houadjeto engages GTA staff, sets vision for tourism growth

10:18

Moses Klu Mensah appointed Deputy CEO of Ghana Export-Import Bank

18:33

Twum Boafo appointed Acting CEO of Financial Intelligence Centre

14:07

Fuel prices to rise as petrol, diesel, LPG costs increase

11:11

Electroland Ghana Limited opens new showroom in Ashaiman

11:02

Alex Dadey pushes diaspora investments for Africa's transformation at Africa Prosperity Dialogues 2025

10:40