Congo seeks mineral deal with U.S. Will Washington step in to curb China's dominance in the sector?

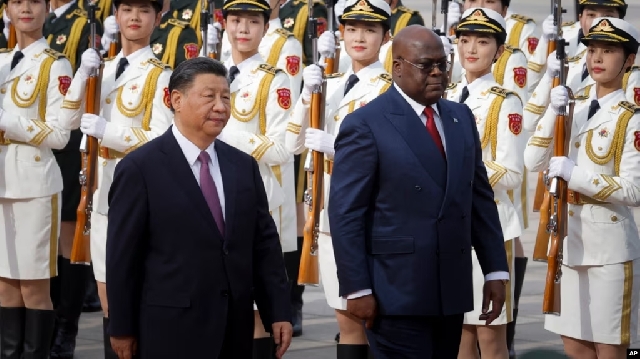

Congolese President Felix Tshisekedi (right) and Chinese President Xi Jinping attend a welcoming ceremony at the Great Hall of the People in Beijing on May 26, 2023

Congolese President Felix Tshisekedi (right) and Chinese President Xi Jinping attend a welcoming ceremony at the Great Hall of the People in Beijing on May 26, 2023

As President Donald Trump pushes the U.S. to become a global leader in the production and processing of non-fuel minerals, the mineral-rich Democratic Republic of Congo has proposed a deal with the U.S. similar to the U.S.-Ukraine mineral agreement to wean itself off its over-dependence on China. Experts say the U.S. could offer Congo an alternative that would curb China’s influence while ensuring Washington’s access to key minerals. But they caution that such a mineral agreement is also fraught with challenges.

In his March 4 speech to a joint session of Congress, President Trump vowed to take “historic action” to “substantially expand production of critical minerals and rare earths” in the United States.

The announcement came as the Democratic Republic of Congo approached the United States to strike a mineral deal similar to the one the United States has with Ukraine.

Democratic Republic of Congo proposes mineral deal

The Democratic Republic of Congo’s president, Felix Tshisekedi, floated the idea of a minerals-for-security deal with the United States in an interview with The New York Times last month. Days later, the African country’s government wrote to Republican Senator Ted Cruz, chairman of the Subcommittee on Africa and Global Health Policy, proposing a “lasting partnership” with the United States.

The letter, written on behalf of the Congolese government by Aaron Poynton, the U.S. chairman of the Africa-U.S. Business Council, highlights the African nation’s leading position as the largest supplier of cobalt and a major producer of lithium, copper, tantalum and uranium that are “integral to the industrial competitiveness and national security of the United States.”

The letter proposed "formalizing a long-term economic and security partnership" and providing the United States with strategic minerals, a deep-water port development project, the creation of a strategic reserve of Congolese minerals, and access to U.S. military bases.

The letter also stressed that “China has historically dominated the DRC’s mineral supply chain,” but emphasized that “President Tshisekedi’s recent policy shift” provides “a rare opportunity for the United States to establish a direct and ethical supply chain.”

US State Department: Open to discussion

A U.S. State Department spokesperson said in an emailed response to VOA that "the United States is open to discussing this partnership."

The spokesperson also confirmed that they were "seeking further information on the (Congolese) president's proposal" and were "in regular contact with our counterparts in the Democratic Republic of Congo."

The thinking behind Congo's proposal

Congo's proposal comes amid fierce fighting between government forces and the Rwandan-backed M23 rebels, which have captured at least 10 percent of all territory in the east of the country.

Christian-Geraud Neema Byamungu, senior analyst for China-Africa relations and editor of Africa Affairs at the China Global South Project, a nonprofit multimedia organization, said that while Congo had been pursuing a policy of diversification away from China “many years ago,” the latest proposals were driven by “security needs” in the current conflict.

“The DRC [proposal] includes two elements that the U.S. government is currently seeking — access to critical minerals and curbing China’s position in the critical minerals sector,” he said.

Under a deal similar to the one in Ukraine that Kinshasa is seeking, the DRC would provide minerals “in exchange for security, peace and stability,” the analyst said.

Tom Sheehy, a distinguished fellow at the Africa Center at the United States Institute of Peace, also noted that "the Congolese want to diversify away from over-dependence on China" because it provides the country with "more options that can better serve them commercially."

Before approaching the United States, the DRC government also sought to win over investors from Saudi Arabia, Europe and India to break its dependence on China.

Democratic Republic of Congo overly dependent on China for minerals

The Democratic Republic of Congo supplies 70% of the world’s cobalt, a core component of lithium-ion batteries needed by industries such as electric vehicles, aerospace, defense and other electronics.

Chinese entities control or hold stakes in 15 of the 19 cobalt mines in the Democratic Republic of Congo.

As the dominant player in the global cobalt supply chain, Beijing imported 100% of the Democratic Republic of Congo’s cobalt exports in 2022 for processing and refining.

China increased its investment in the DRC's mining sector in the 1990s. However, the biggest milestone came in 2008 when the government of Joseph Kabila signed a $6 billion deal with a consortium of Chinese companies, Sicomine. The consortium was granted mineral rights in exchange for infrastructure development. Under the agreement, the Chinese group pledged to provide infrastructure investments of around $3 billion.

Since then, Chinese entities have consolidated their presence in the country. In 2016, another Chinese mining company, China Molybdenum Co., Ltd., acquired a controlling stake in the copper-cobalt mine Tenke Fungurume from Freeport-McMoRan Inc., an international mining giant headquartered in Phoenix, Arizona, USA. The mine is the world's largest, highest-grade and most promising cobalt mine.

However, Chinese mining companies face accusations of violating the terms of the agreements, engaging in illegal mining and condoning human rights violations.

In January 2024, the DRC renegotiated the 2008 agreement after alleging that Sicomine had not delivered $1 billion of the $3 billion it had promised to invest in infrastructure. Now Sicomine has agreed to invest up to $7 billion in infrastructure.

Jacqueline Zimmerman, deputy project manager for the China Development Finance Project at AidData, a research lab at the University of William and Mary in Virginia, said the Sicomine renegotiation represented “a marginal victory for the rights of a resource-rich government for a period of time”.

Shea of the U.S. Institute of Peace also stressed that "China generally does not respect the terms of various agreements."

“China is still very dependent on Chinese labour at the expense of Congolese labour, and there are environmental and corruption issues,” he added.

However, Biyamungu of the China Global South project noted that of all Chinese mining investments, only two contracts related to Sicomine were renegotiated and only one contract committed to building infrastructure.

“Besides these two contracts, you have at least 15 or 16 other Chinese mining companies operating on the ground,” he added.

Despite the multi-billion dollar deal, the DRC remains one of the poorest countries in the world, blamed on weak governance structures, corruption and political instability.

Will the United States intervene?

On the first day of his second term, President Trump signed the Unleashing American Energy Executive Order, detailing the new administration’s strategy on critical minerals.

The order pledged to "assess the national security implications of the nation's dependence on minerals" and establish the United States as a "major producer and processor of non-fuel minerals."

Soon, Ukraine's mineral deal was on the table.

The signing of the deal was delayed following a public showdown between President Trump, Vice President Vance and Ukrainian President Volodymyr Zelensky at the White House on February 28.

Under the terms of the agreement, the two countries will set up and jointly manage an investment fund with the goal of using the funds for Ukraine's reconstruction. Although the agreement does not include any security guarantees, it ensures U.S. economic involvement.

Shea of the US Institute of Peace said a similar agreement with the Democratic Republic of Congo would probably not work because the conflict between Congo and Rwanda is a "fundamentally political conflict."

He added: “A lot of work needs to be done to formalise, normalise and legalise the exploitation of Congo’s natural resources.”

He also believes that the Congolese government has a responsibility to ensure a good investment environment.

“Congo needs to do more to make their investment opportunities attractive to Western investors. Hopefully that process is starting,” he said.

Challenges facing the United States in competing for mineral resources in Africa

Comparing the U.S. mineral strategy to that of China, Sheehy said, “The U.S. is not going to go in and build infrastructure and adopt a state-supported model.”

“What the United States can do is offer its diplomatic support, work with the Congolese government, work with neighboring governments, as it did with the Lobito corridor, and try to create an environment that is attractive for U.S. investment,” he said.

The Lobito Corridor is the largest U.S.-led effort to counter Chinese influence in Africa. The joint U.S.-European project, approved under the Biden administration, will connect the southern region of the Democratic Republic of Congo, northwestern Zambia and Angola, giving the U.S. and other partner countries access to key minerals in the region.

However, Biyamungu of the China Global South Project said the Lobito corridor model was not a "perfect blueprint".

“I very much doubt that this can be a model for any kind of collaboration that might take place in this context,” he added.

As the Trump administration considers the DRC proposal, Brooke Escobar, interim director of AidData’s China Development Finance Project, highlighted how China’s strategic presence in mineral supply chains makes it difficult for Western companies to operate effectively in the region.

“China uses its ‘Belt and Road’ financing to provide subsidized credit to its companies, lowering the barriers for Chinese companies to enter the industry and making the ongoing operating costs of the industry lower than for companies in the United States or other Western countries,” she said.

“While the United States scrambled to react, China spent more than a decade methodically building and expanding its dominance in the transformational mineral supply chain,” she added.

Sun Yun, director of the China program at the Washington think tank Stimson Center and a visiting fellow at Brookings, also believes that the United States still faces great challenges in competing with China for key mineral resources in Africa.

"China has spent diplomatic resources in Africa that the United States may not be able to match - while the Chinese foreign minister regularly visits Africa during the New Year, the U.S. Secretary of State rarely visits Africa. Chinese companies are also far ahead of the United States in their layout in key mineral sectors in Africa," she said in an article she wrote for VOA in January this year.

She said that considering that the US foreign policy has long focused on crisis issues, such as the Russia-Ukraine war and the Middle East, it is difficult for Africa to become the focus of the US foreign strategy. In this case, how the Trump administration will compete with China in the field of critical minerals remains to be seen.

Source: voanews.com/Nayan Seth

Trending World

Pope Francis laid to rest

17:07

Images of Pope Francis's tomb released

02:51

South Africa will defend sovereignty, ANC chair says as tensions with US grow

02:45

College of Cardinals sets May 7 for Papal conclave to elect Pope Francis' successor

03:09

Who will be the next pope? Key candidates in an unpredictable process

13:45

Pope Francis funeral sets for today

16:23