Tax exemptions for 45 companies ‘unconscionable’ – Minority

The Minority presented a list of the 45 companies in question and reiterated their concerns about the potential adverse effects on the nation's economic landscape

The Minority presented a list of the 45 companies in question and reiterated their concerns about the potential adverse effects on the nation's economic landscape

The Minority in Parliament has expressed disapproval over government's extensive request for tax exemptions, labelling them as “unconscionable, inordinate, and bearing all the trappings of organised crime.”

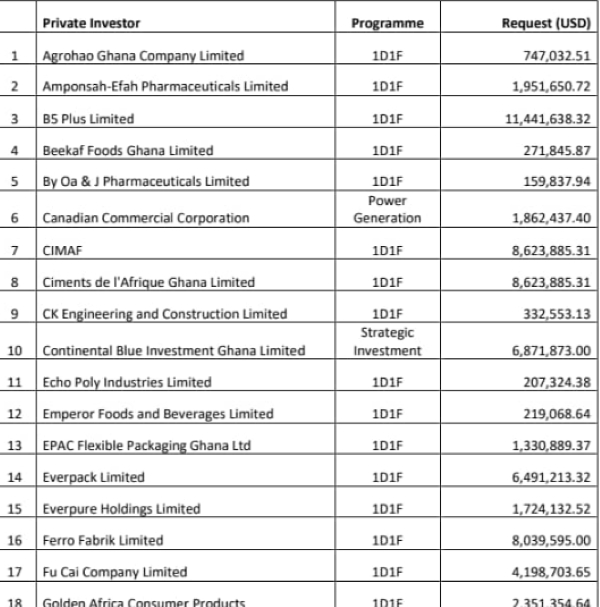

According to the Minority, approximately 45 companies have been presented to Parliament under designations such as one district-one-factory companies and GIPC strategic investors, seeking exemption from tax payments.

In a statement issued on Monday,27 November 2023, the Minority disclosed that the government is urging Parliament to grant tax exemptions totalling USD 449,446,247.95 for these 45 companies, equivalent to over half of GHS5.5 billion.

Emphasising the gravity of the situation, the Minority asserted that this issue significantly impacts the country's economy, and they felt obliged to inform “the Ghanaian taxpayer who is being burdened with all manner of taxes know this truth.”

The statement further revealed that an additional 118 companies are currently undergoing processing at the Ministry of Trade & Industry, Ministry of Finance, and the Ghana Investment Promotion Centre for future presentation to Parliament for tax exemptions.

The collective value of exemptions for these 118 companies is estimated at about GHS7 Billion.

The Minority presented a list of the 45 companies in question and reiterated their concerns about the potential adverse effects on the nation's economic landscape.

Find below all 45 companies listed by the Minority:

Source: classfmonline.com

Trending News

President Mahama establishes anti-flood taskforce to tackle flooding

02:57

NPP members in Volta Region reject Kofi Lugudor’s election expense report

11:32

Napo’s wife unveils initiative to champion mental wellbeing, financial literacy

06:58

Ashanti Regional Health Director calls for strengthened primary healthcare

02:47

A/R: Rainstorm wreaks havoc in Amakye-Bare

09:38

Gov't takes over Savannah College of Education

06:42

There's no freeze on employment - Finance Minister to NPP

02:32

Ghana commemorates 73rd Commonwealth Day with call for global cooperation

09:12

Chinese ceramics firm given one-week ultimatum to halt activities polluting river Anankore

17:51

Turkish Ambassador calls on Minister for Energy and Green Transition

02:25