Fitch assigns Ghana's new USD bonds 'CCC+' rating; upgrades LTLC IDR to 'CCC+'

Fitch also upgraded Ghana's Long-Term Local-Currency (LTLC) Issuer Default Rating (IDR) to 'CCC+' from 'CCC'

Fitch also upgraded Ghana's Long-Term Local-Currency (LTLC) Issuer Default Rating (IDR) to 'CCC+' from 'CCC'

Fitch Ratings has assigned Ghana's new US dollar bonds, issued on 9 October 2024, a 'CCC+' rating.

Fitch also upgraded Ghana's Long-Term Local-Currency (LTLC) Issuer Default Rating (IDR) to 'CCC+' from 'CCC'.

Additionally, Fitch affirmed Ghana's Long-Term Foreign-Currency (LTFC) IDR at 'RD'.

In a statement, Fitch said it typically does not assign Outlooks to IDRs of sovereigns with a rating of 'CCC+' or below.

Fitch also said it affirmed the 'CC' rating on Ghana's US dollar-denominated notes partially guaranteed by the International Development Association (IDA), part of the World Bank Group, due October 2030, and subsequently withdrew the rating.

The issue rating for the IDA partially guaranteed note maturing in 2030 (ISIN US374422AD53 and ISIN XS1297557412) has been withdrawn as the note will no longer exist because of its restructuring.

Key Rating Drivers

Eurobond Exchange Concluded: Ghana has successfully concluded a debt exchange for its 15 outstanding non-performing Eurobonds, including the IDA-partially guaranteed notes. This follows consent reached on 98.58% of the total outstanding amount, and each series has received consent representing more than 92% of the outstanding principal, meeting the respective collective action clause thresholds.

As a result, the 15 Eurobonds have been exchanged for five new bonds and distribution to eligible holders was completed on 10 October 2024. The assignment of a 'CCC+' rating to these five bonds reflects our assessment of Ghana's expected credit profile after completion of the whole debt restructuring, with a declining debt supported by ongoing fiscal consolidation, and elevated liquidity risks with interest spending relative to revenue which is still high.

Significant Reduction in Terms: In exchange for the 15 outstanding Eurobonds with a total face value of USD13.1 billion, investors were offered a set of new bonds, with two options. Under the 'disco' option, a nominal haircut of 37% applies on all claims, which then is restructured into two new notes - a step-up coupon amortising note due 2029 and a step-up coupon amortising note due 2035. The step-up coupon rates range from 5% to 6%.

Under the 'par' option there is no nominal haircut but claims are restructured to a 1.5% amortising note due 2037. Both the 'disco' option and 'par' option receive a zero-coupon amortising note due 2026 and a zero-coupon note due 2030 in exchange for past-due interests.

The restructuring does not provide for value-recovery instruments. Tenders representing a total of USD994.8 million opted for the par option (below the cap of USD1.6 billion).

Substantial Debt Relief: The Eurobond exchange entails a reduction in Ghana's FC debt stock (including PDIs) of around 6% of the estimated 2024 GDP. FC debt service is reduced by USD 3.5 billion over 2024-2026. Interest payments are reduced by 1.3% of GDP in 2024, 0.9% in 2025 and 0.6% in 2026 compared with interest payments due under the original terms of the bonds. These estimates do not factor in the cost of rolling over bonds (at increased coupon rates, given market conditions) that would have matured in 2023-2026, implying larger actual debt relief.

Declining Debt: Assuming a similar treatment of FC commercial debt that still needs to be restructured, the debt stock reduction would reach 7% of the estimated 2024 GDP. This, combined with a strong medium-term growth forecast and ongoing fiscal consolidation, will contribute to a decline in the central government's debt, to 70% of GDP in 2024 and 68% in 2025 and 2026, from 77% of GDP in 2023.

Official Treatment Adds to Relief: The Eurobond treatment was designed to be comparable in scale (although likely different in terms of parameters of present value reduction, debt-service reduction over the IMF programme period, and duration) to the official sector treatment, for which terms of the June 2024 memorandum of understanding have not been disclosed. Incorporating the official treatment would entail a further reduction of the debt-service burden.

Remaining FC Debt in Default: The affirmation of LTFC IDR at 'RD' reflects Ghana remaining in default on some of its external commercial debt, pending a restructuring. The Eurobond exchange covenants contain a most-favoured creditor clause that restricts the country from restructuring debt with its remaining creditors on more favourable terms (on a present value basis) without offering consideration of equivalent value to noteholders. We estimate Ghana will complete its external debt restructuring by early 2025.

LTLC IDR Upgraded: The upgrade of Ghana's LTLC IDR to 'CCC+' reflects our increased confidence that the likelihood of another default on Ghana's LC debt is being reduced with the completion of the Eurobond restructuring, as this further unlocks access to concessional international finance. On 4 October 2024, Ghana and the IMF reached a staff-level agreement on the third review of the extended credit facility, unlocking USD 360 million once approved by the IMF board.

Easing But Still Elevated Liquidity Pressures: The upgrade is also supported by an expected reduction in liquidity pressures, with some favourable macroeconomic developments, in particular lower inflation contributing to an anticipated reduction in LC financing cost. Still, we expect interest payments to represent 29% of revenue in 2025 and 31% in 2026, far beyond the 'B'/'C'/'D' median of 15%.

Large Fiscal Consolidation: We estimate the 2024 primary surplus, on a commitment basis, will reach 0.3% of GDP, representing a 4.6pp adjustment compared with 2022, mainly driven by a 4.1pp reduction in primary expenditure. Despite a record of fiscal slippage in election years, we consider the risk to be low in the lead-up to the elections due in December 2024, given the strong commitment of the authorities to the IMF programme and the 1H24 fiscal data on track to meet Ghana's commitments. However, there is greater uncertainty over the degree of commitment of a new administration. We project Ghana's primary surplus to reach 0.9% of GDP in 2026 on a commitment basis.

IDA-Partially Guaranteed Notes: The notes have benefitted from three USD49.99 million payments by IDA under the 40% of outstanding principal amount guarantee in April 2023, October 2023 and April 2024, and a final USD212 million payment will be made in the coming days. The affirmation of Ghana's bond partially guaranteed by IDA reflects our estimation of a nominal recovery rate in the 51%-70% range. We have subsequently withdrawn the issue rating on the partially guaranteed notes, as they will no longer exist because of their restructuring.

ESG - Governance: Ghana has an ESG Relevance Score (RS) of '5' for both Political Stability and Rights and for the Rule of Law, Institutional and Regulatory Quality and Control of Corruption. These scores reflect the high weight that the World Bank Governance Indicators (WBGI) have in our proprietary Sovereign Rating Model. Ghana has a medium WBGI ranking at the 50th percentile, reflecting a recent track record of peaceful political transitions, a moderate level of rights for participation in the political process, moderate institutional capacity, established rule of law and a moderate level of corruption.

ESG - Creditor Rights: Ghana has an ESG Relevance Score (RS) of '5' for Creditor Rights as willingness to service and repay debt is highly relevant to the rating and is a key rating driver with a high weight. The rating on Ghana's LTFC IDR reflects Fitch's view that Ghana is in default.

Trending Business

Ghana, Brazil deepen agricultural cooperation as Ambassador Namoale courts investment for livestock sector

17:24

GoldBod generated over US$8 billion from small-scale gold exports

12:58

GCAA Ag. DG brokers internship deal with Qatar Civil Aviation Authority

11:25

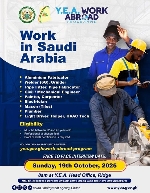

YEA opens work abroad opportunities for skilled professionals in Saudi Arabia

15:44

China grants additional ¥200 million to Ghana for Aflao market and National Theatre projects

13:07

GIHOC Distilleries demands retraction and apology from Joy News over erroneous reportage

13:00

It took NLA 9 years to generate GHS 3.065 billion -Razak Kojo Opoku to Fourth Estate

10:49

Mozambique studies Ghana’s Goldbod model amid gold market reforms

03:53

Energy Minister commends BOSTEnergies for strategic reforms and commitment to fuel security

03:16

Damaged 161kV Aboadze–Tarkwa transmission line under repair-Energy Ministry

03:09