E-cedi rollout: 'BoG one of the most cyber secure central banks in Africa' – IPMC CEO

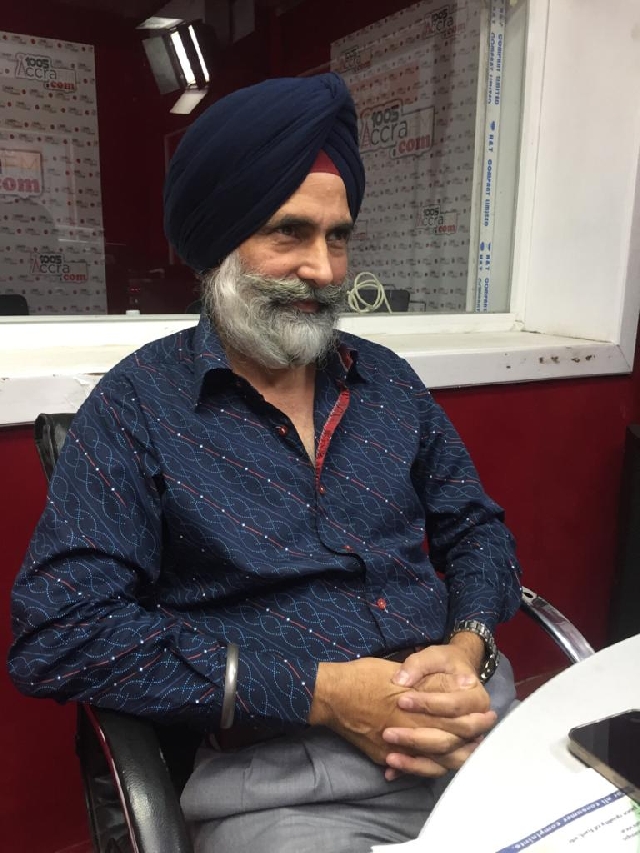

CEO of Intercom Programming & Manufacturing Company Limited (IPMC), Mr Amardeep S Hari

CEO of Intercom Programming & Manufacturing Company Limited (IPMC), Mr Amardeep S Hari

The Bank of Ghana is “one of the most secure central banks in Africa, as far as technology is concerned”, the CEO of Intercom Programming & Manufacturing Company Limited (IPMC), Mr Amardeep S Hari, has said.

Speaking in separate interviews with Accra100.5FM’s Ghana Yensom and Class91.3FM’s Class Morning Show about plans by Ghana to introduce a BoG-backed digital currency, Mr Hari, who has been in Ghana for the past 30 years, said the central bank has “a full-fledged cybersecurity control room and a very secure data centre”.

“So, Bank of Ghana is very far advanced in technology”, he told hosts Kwame Appiah Kubi and Kofi Oppong Asamoah on Thursday, 12 August 2021.

“They [BoG] have been very proactive and forthcoming in adopting technology for many many years”, Mr Hari said.

Buttressing his point, he noted: “They [BoG] were one of the first ones to do that among all the other African nations”, adding: “And there will be no surprise if Ghana becomes the first country for having an e-currency”.

“We are already far much ahead of any other country, as far as mobile money is concerned, though the mobile money started later here than those countries in East Africa but since the time we started, we have become the leading nation and we are about to leave even those countries in East Africa behind so that’s a [piece of] very good news for everybody that we are the one of the best performance with mobile”.

“And what is mobile money? It’s e-currency in itself, so, when this mobile money evolves into a new phase which can be called e-cedi, then why not? We are all getting there and we are all ready for that”, he said.

On Wednesday, the Bank of Ghana announced that it has partnered with Giesecke+Devrient (G+D) to pilot the general-purpose Central Bank Digital Currency (retail CBDC) in Ghana.

G+D is providing the technology and developing the solution adapted to Ghana’s requirements, which will be tested in a trial phase with banks, payment service providers, merchants, consumers and other relevant stakeholders.

To this end, the Bank of Ghana has signed an agreement with G+D to implement a pilot CBDC project, as a precursor to the issuance of a digital form of the national currency, the cedi.

The project is part of the 'Digital Ghana Agenda', which involves the digitisation of the country of 30 million people and its government services.

The digital cedi, or 'e-cedi', according to the central bank, is intended to complement and serve as a digital alternative to physical cash, thus, driving the Ghanaian cashlite agenda through the promotion of diverse digital payments while ensuring a secure and robust payment infrastructure in Ghana.

It also aims to facilitate payments without a bank account, contract, or smartphone, thus, boosting the use of digital services and financial inclusion amongst all demographic groups.

The project, according to the BoG, will be divided into three phases: design, implementation and pilot.

In the design phase, all framework parameters for the CBDC pilot will be specified and defined. These include economic, regulatory and technical requirements of the country as well as the definition of the parameters for the test phase.

In accordance with these individual requirements, G+D's CBDC solution would be adapted for the Ghanaian context in the second phase.

In the pilot phase, a user group of diverse demographic and socio-economic backgrounds will test the solution in the field using different channels and form factors such as mobile apps and smart cards. Over the course of the pilot project, a study will be conducted on the acceptance of the e-Cedi from the end users' perspective.

In addition, the IT security of the infrastructure, impact of the project on monetary policy and payment system, and the legal implications will be evaluated. Insights from pilot user experiences would then provide Bank of Ghana and G+D with valuable lessons for a nationwide rollout of the e-Cedi.

Dr. Ernest K. Y. Addison, Governor of the Bank of Ghana, stated: “CBDC presents a great opportunity to build a robust, inclusive, competitive and sustainable financial sector, led by the Central Bank. From all indications, the concept has a significant role to play in the future of financial service delivery globally. This project is a significant step towards positioning Ghana to take full advantage of this emerging concept.”

"Central banks around the world are exploring the introduction of digital money as legal tender. The Ghanaian government is one of the first African countries now entering a pilot phase. We are proud to support Ghana with our technology and expertise," Dr Wolfram Seidemann, CEO of the Giesecke+Devrient Currency Technology business sector stated for his part.

Source: classfmonline.com

Trending Business

Take advantage of improving food conditions to rebuild savings – Government Statistician urges Ghanaians

15:20

Gov’t to roll out major VAT reforms in 2026 – Ato Forson

10:43

GIPC CEO engages U.S. Embassy on new investment bill

09:05

National Poultry Farmers VP warns egg sellers against overpricing as feed costs drop

12:13

Road Fund saddled with GHS 8bn as gov't undertakes independent audit to verify claims

11:38

Farmers’ bank: A lifeline for Ghana’s agricultural sector and growth-Sosu

10:36

Finance Minister visits Osu Tax Service Centre, pledges strong support for revenue mobilisation

06:57

Mahama's government committed to supporting farmers – Elizabeth Ofosu-Adjare

14:39

Volta Young Entrepreneurs Forum 2025: Mama Bobi III and Mrs Appau-Klu honoured for empowering the girl child

16:55

Electrical contractors call for direct government contracts to improve public safety

11:50