Africa50 launches $500m infrastructure acceleration fund, attracting prominent investors

African and global investors sign subscription agreements for Africa50 Infrastructure Acceleration Fund

African and global investors sign subscription agreements for Africa50 Infrastructure Acceleration Fund

In a significant milestone for Africa, prominent institutional investors from Africa and around the world have joined forces to support the newly launched $500 million Africa50 Infrastructure Acceleration Fund. This fund, established by Africa50, represents the first private vehicle infrastructure platform of its kind.

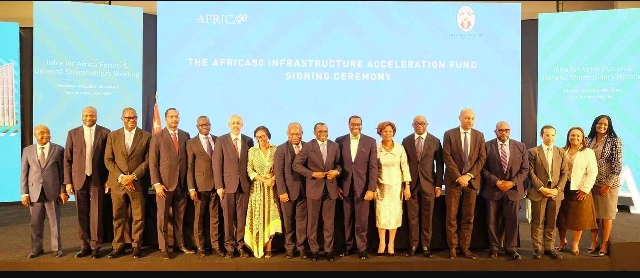

The collaboration brings together a diverse group of influential stakeholders, including 17 African shareholders and two international institutional investors. The African shareholders consist of sovereign wealth funds, development finance institutions, banks, pension funds, asset managers, and retirement agencies. It is expected that additional entities will join the initiative in the future.

To solidify their commitment, the shareholders signed subscription agreements and letters of intent to invest in the fund during the Africa50 Infrastructure Forum and General Shareholders Meeting, held in the capital of Togo on Monday, July 3rd.

The primary objective of the Africa50 Infrastructure Acceleration Fund is to attract increased investment to the development of critical infrastructure across the African continent. This includes sectors such as energy, transportation, telecommunications, water, and other areas essential for sustainable development.

During the signing event, Dr. Akinwumi Adesina, President of the African Development Bank and Chair of the Africa50 board, expressed his enthusiasm for the unprecedented collaboration, stating, "With the Fund, we are positioning the Africa50 Group to play a lead role in helping to tap into the more than $98 trillion of global assets under management."

The African Development Bank itself is investing $20 million in equity in the Africa50 Infrastructure Acceleration Fund. Other notable investors include the International Finance Corporation, the Nigeria Sovereign Investment Authority, the Arab Bank for Economic Development in Africa, the West African Development Bank, CDC Sénégal, CDC Benin, CNSS Togo, CDG Invest, and Attijariwafa Bank of Morocco.

Aminu Umar-Sadiq, CEO and Managing Director of the Nigeria Sovereign Wealth Fund, emphasized his agency's focus on sustainable infrastructure and its commitment to contributing to Africa's economic growth and development. He stated that their investment in the Africa50 Infrastructure Acceleration Fund provides an opportunity to make a positive impact while generating attractive financial returns.

Dr. Sidi Ould Tah, CEO of the Arab Bank for Economic Development in Africa, expressed delight in partnering with Africa50 to scale up infrastructure development on the continent. He recognized Africa's potential and affirmed the bank's commitment to supporting the region's growth.

Alain Ebobissé, CEO of Africa50, highlighted that securing commitments from prominent African institutional investors marks the beginning of a new era of collaboration and investment in Africa's infrastructure sector. He emphasized the shared vision to transform Africa's infrastructure landscape and drive prosperity, job creation, and sustainable development for all Africans.

The Africa50 Infrastructure Acceleration Fund is a 12-year closed-end infrastructure private equity fund. It mobilizes long-term institutional capital from African and international institutions and will primarily make equity and quasi-equity investments, including majority stakes, in infrastructure projects across Africa.

Source: Classfmonline.com

Trending Business

President Mahama appoints Capt. James Richmond Quayson as the Director of Takoradi Port

13:10

Replicate Kwahu Business Forum nationwide- UCC don to Mahama

09:27

Better Ghana Alliance rebuts DPPF’s hailing of KGL as Africa’s top lotto company

09:13

New policies will hurt mining sector growth - Minority to gov’t

08:27

Ato Forson leads Ghana to participate in first IMF /World Bank Spring Meetings in Washington DC

02:50

SIC Insurance courts GPHA to expand insurance partnership

01:14

IMF boss applauds Ghana’s economic turnaround under Mahama administration

03:35

NIB MD champions community-led development at Kwahu Business Forum

03:14

IACG targets 1,000 market traders and artisans in the Western and Western North Regions as part 2025 micro business clinics

10:28

Basintale blocks renewal of Zoomlion's contract if salary remains GH¢250

13:14